Legal Life Cycle of a Business

All the contracts and legal issues your business may face from start-up to acquisition to listing to liquidation

By Ronald JJ Wong

As a lawyer, I’ve worked with clients from start-up founders to CEOs and Board Directors of listed companies. I get questions from time to time about their legal problems and shortfalls in their legal documentation. Just like it’s prudent to have annual medical check-ups on our health, businesses would do well to have regular legal health diagnostics.

This article explains the general legal issues and legal documents, contracts, and agreements which a business can expect to encounter through its lifecycle from founding to seed, from maturity to liquidation.

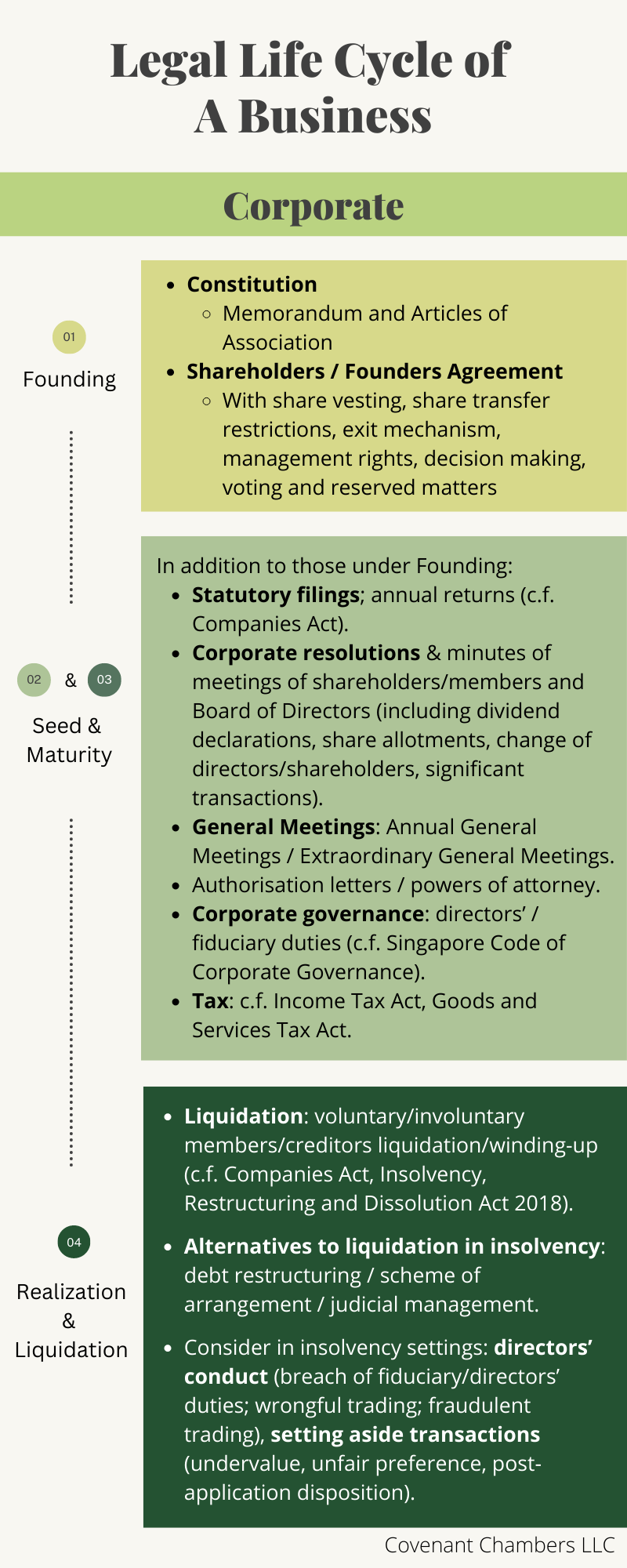

Generally, a business will have 6 core functional areas: strategy, finance, human resources, operations, marketing, and assets (e.g., technology, equipment, real estate). Each area may give rise to legal issues, but the legal issues for some areas may be generalised under certain themes, which I elaborate on below. As the business grows from stage to stage, different legal considerations arise. The main stages are as follows:

1. Founding:

At this stage, a business will be registered. The appropriate legal form needs to be adopted (e.g., private company limited by shares, limited liability partnership, partnership, sole proprietorship). The legal form will mainly affect the personal liability of shareholders/partners, tax liability & financing/fundraising options. The founders should have certain constitutional documents drawn up to govern their internal relationships, set expectations, incentivize long-term growth & development, and set boundaries to prevent a bitter divorce.

2. Seed

As the start-up begins business and grows, it will deal with various third parties e.g., customers, suppliers, landlords, consultants, independent contractors/freelancers, and employees. It may need external financing beyond founders’ bootstrapping. Seed investors may come in as lenders or shareholders.

3. Maturity

As the business matures, the business will need more financing to expand its operations and market. Profits may be distributed to shareholders. At this stage, the business may also begin to acquire other businesses for strategic and commercial purposes.

4. Realisation/Liquidation

The business also eventually becomes a listed public company through an IPO or itself be acquired. Or if a business fails and becomes insolvent or the shareholders are unable to continue to operate the business together, the business may eventually be liquidated through voluntary or involuntary winding up.

In conclusion, the legal life cycle of a business has many key pointers to note, and the list below is not exhaustive. If you wish to seek advice on any of the above matters, kindly contact us at info@covenantchambers.

Disclaimer: The information and materials provided does not constitute legal advice and does not purport to give rise to a lawyer-client relationship. You are fully responsible for seeking specific legal advice from a lawyer before taking any legal action.